Tech Survey By A4A Shows Schwab PortfolioCenter Remains No. 1 Portfolio Reporting App But Field Of PMS Vendors Is Growing Hot

Write Review

| Investment Advisor Software Reports |

|---|

| CRM |

| Financial Planning |

Just over a quarter of the advisors polled by A4A say they do not use any portfolio accounting and reporting application. While the vast majority investment advisors would not practice without a PMS application, these advisors are content providing only brokerage statements to clients. This illustrates the broad spectrum of practice methods among independent financial advisors.

Morningstar Office is the fastest growing PMS provider, with 9.2% of A4A using it. In addition, the 2.5% of advisors who identified dbCAMS as their PMS app are also actually users of Morningstar’s platform, since Morningstar acquired dbCAMS three years ago.

With 2,129 advisors of A4A’s 4,500 members responding to our questionnaire about which PMS application they use, the data reflects preferences among a broad swath of independent advisors. However, like all of the surveys of advisors by advisor publications, is not a scientific sample of private wealth advisors.

.png)

The data reflect the PMS preferences of members of A4A. Seventy percent of A4A members say they work at a “pure” Registered Investment Adviser (RIA) as an investment advisor rep and have no broker-dealer affiliation, while 14% say they are registered reps, and 16% say they are “dually-registered" as an IA rep also licensed to sell securities.

An example of the sampling bias inherent in advisor surveys is that only 14.1% of A4A members use Albridge as their PMS app. Albridge says it is used by more than 100,000 advisors and has far more users than Schwab PortfolioCenter. However, since A4A is dominated by investment advisors not affiliated with broker-deals, the results reflect that. Similarly, SunGard’s PMS app is not popular with RIAs dominating A4A’s membership but is popular with private client services at banks and trust companies.

Interestingly, Advent (9.9%) trails PortfolioCenter (23.3%) in popularity by a wide margin, while both companies claim about the same number of users among RIAs.

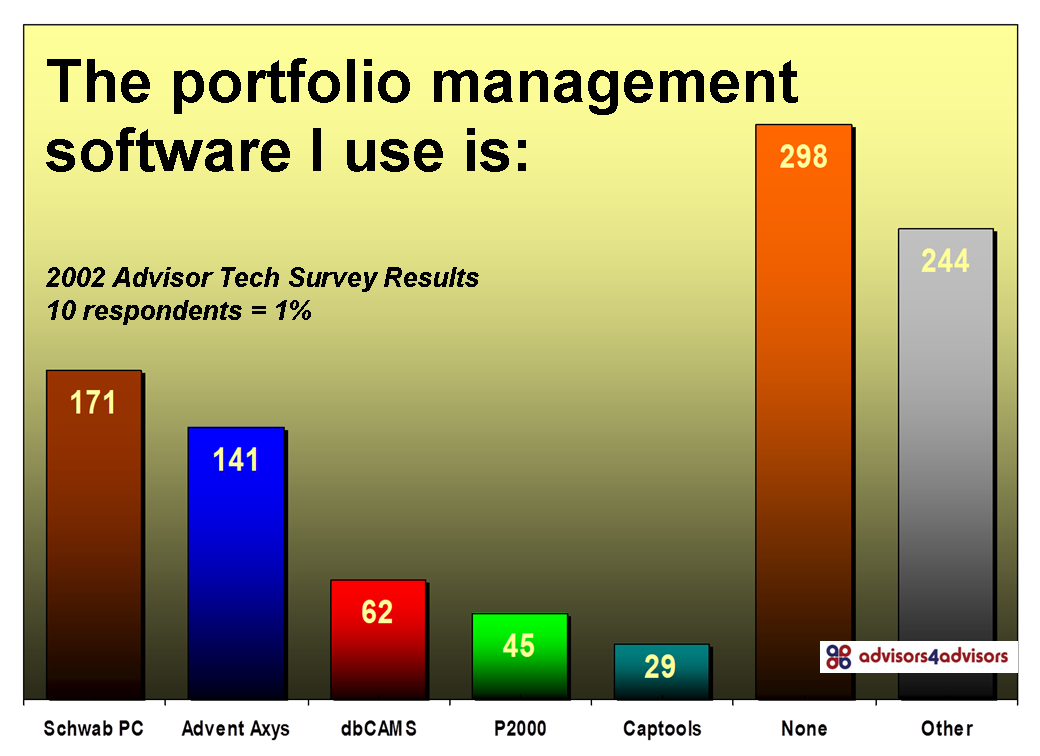

To put the PMS survey data in perspective, it’s helpful to compare the results to a survey of 1,100 advisors that I conducted in 2002 when I was a columnist at Investment Advisor. A decade ago, my survey asked about five PMS apps, while the current survey lists 14 apps. Also note that more than half the choices in today’s survey are Web-based, while none of the choices a decade ago were online apps.

While a couple of software companies dominated the PMS category a decade ago, the market is now much more fragmented. This is the trend across all categories of practice management apps categories targeted to the independent financial advice business.

As software development becomes easier, more companies have entered the field. This trend is unlikely to stop anytime soon.

Startups run by those familiar with the private wealth business are proving adept at carving out a niche and providing the technology and service advisors demand to create profitable businesses. The success of firms like AssetBook and Orion Advisor Services, which each serve 200 RIAs and did not exist a decade ago, and the sale of BlackDiamond Reporting to Advent Software for $73 million in May 2011, indicate that technology vendors targeting RIAs will continue to flourish.

Established providers like PortfolioCenter and Advent are likely to continue to face growing competition from startups in the decade ahead and the market share among PMS apps will continue grow more fragmented.

This Website Is For Financial Professionals Only

User reviews

There are no user reviews for this listing.