If You’re Not Managing 401(k) Assets, You’re Leaving Money On The Table Hot

Write Review

Your clients come to you because they trust you and value your expertise. They obviously don’t feel confident managing their own investments. Imagine saying to your clients, “I can manage your 401(k) investments and integrate them with the rest of your portfolio.” From experience, I can tell you how they will react: They will jump at the opportunity and consider themselves lucky that you can do this for them! And, they will not have an issue with you billing on those assets.

Let’s get down to the details of how, what and why. How can you manage your clients’ 401(k) accounts? You can do so by downloading the data into your portfolio accounting system through a program like ByAllAccounts. For example, ByAllAccounts can download a client’s 401(k) information directly into PortfolioCenter. You can then manage the 401(k) as if it was any normal part of your client’s portfolio holdings.

Managing 401(k)s can offer your clients many benefits:

· You can “cherry pick” the funds you like in the 401(k) plan and avoid the ones you don’t like.

· You can more effectively carry out location optimization (fixed income in the 401(k) and equities in the taxable account)

· You will be managing the investments!

Why should you pursue managing your clients’ 401(k) assets? Because they need you! And, you can increase your AUM without even adding new clients! It’s a win-win deal, so why are you waiting?

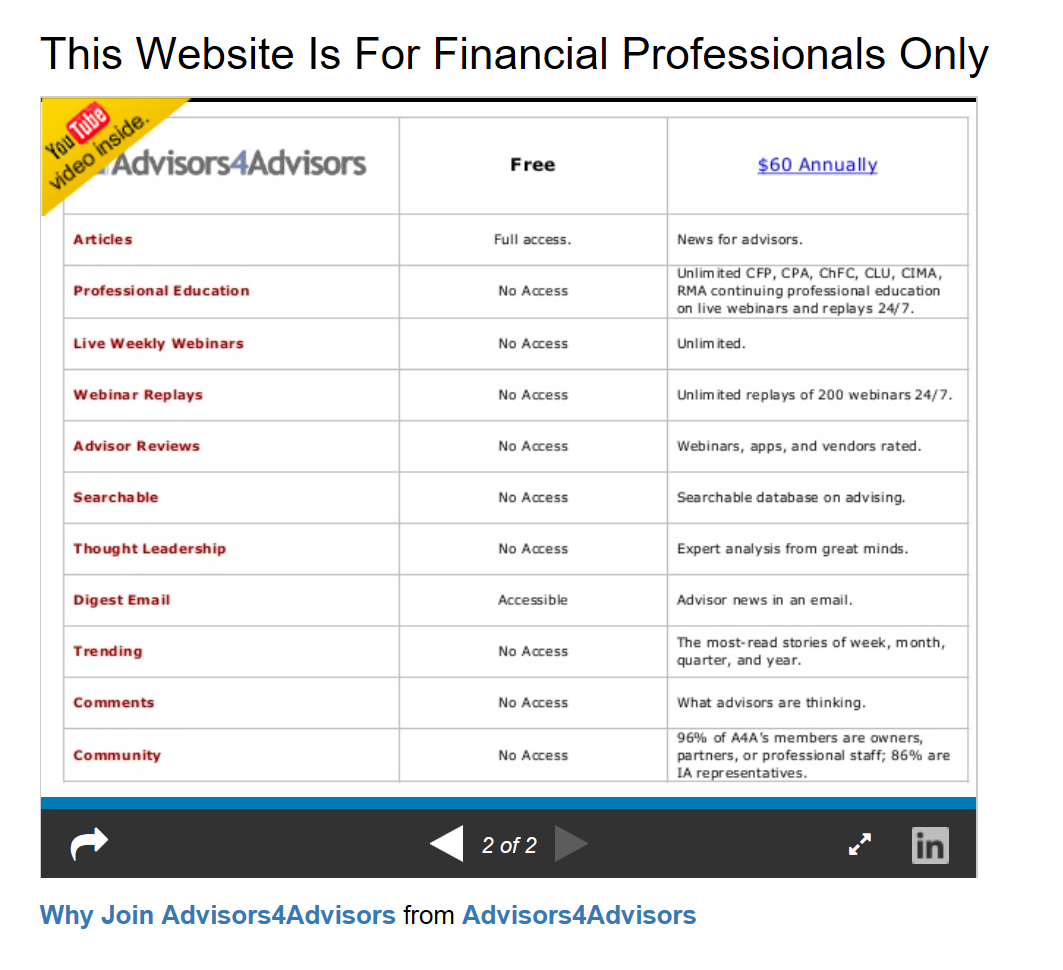

This Website Is For Financial Professionals Only

User reviews

There are no user reviews for this listing.