Eight-Credit Bob Keebler Tax Planning IRA, Qualified Plan CE Course Hot

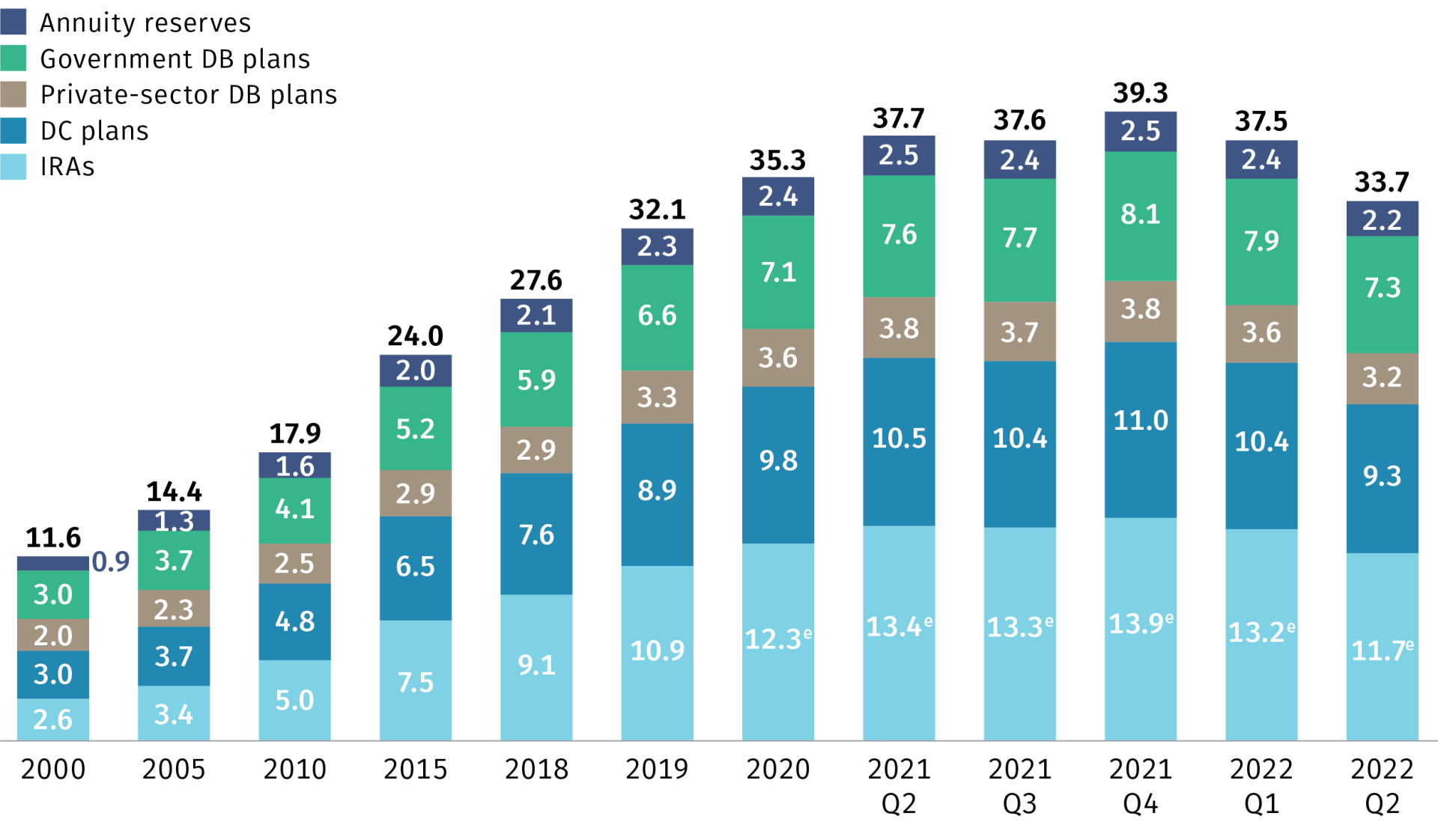

Total US retirement assets were $33.7 trillion as of June 30, 2022, accounting for 31% of all household financial assets in the United States.

| BUY NOW |

Which is why A4A and Robert Keebler have produced an eight-credit on-demand CE course devoted entirely to tax planning for federally quaified retirement plan (QRP) accounts at a highly affordable price. .

Since 2011, Bob Keebler has taught monthly on A4A, and we are proud to provide this annual eight-hour course on IRAs and QRPs. Organizing the topic into eight modules makes refreshing your knowledge annually easier, allowing comprehensive explanations across the broad swath of knowledge topics. Key facts.

|

|

TOTAL US RETIREMENT ASSETS |

| Source: ICI |

- Bob Keebler comprehsnively reviews this key practice knowledge topic

- eight hours of CE credit on-demand

- income, gift, and estate tax planning

- answers from Bob Keebler to your questions

- transcripts and slides for all eight classes

- an authoritative, searchable IRA/QRP knowledge base

- listing on Advisors4Consumers

IRA/QRP planning may be the single-most important knowledge topic for financial advice professionals to master, and it is technically challenging because there are so many rules, qualifiers, and exceptions.

Bob Keebler built his reputation as a leading educator of financial and tax planning professionals by teaching about tax planning for IRAs and QRPs.

Join at 50% off the regular price of $199 by midnight Dec. 31, 2022 by signing up using code FQP50