The National Life Insurance Consumer Competition

- Details

-

Written by Glenn Daily

Every advisor knows that people make many bad decisions about life insurance, leading to unnecessary costs. Who doesn’t have clients who have sunk a lot of money into life insurance policies with little to show for it?

These mistakes add up. In 1997, James H. Hunt, the life/health actuary of the Consumer Federation of America, estimated that consumers lose $6 billion each year from the purchase of cash value life insurance policies that are later dropped.

I have long wondered what would happen if all Americans were automatically enrolled in a national competition to pay the lowest lifetime cost for the amount of life insurance that they need. Everyone would be able to see their national ranking, and big prizes would await the leaders. Would people make different decisions?

What we have now is a lack of accountability. An agent sells Cash Value Policy A. Some years pass and then the same agent, or a different one, because the first agent has moved on to something else, persuades the consumer to replace Policy A with Policy B, which is supposedly better. Policy B yields to Policy C, and so on. At each step, the consumer thinks that he is now better off, because the agent has made a persuasive case that the new policy is better than the old one.

However, the consumer never receives a performance evaluation as a life insurance buyer, starting from his first purchase and continuing to the present. Has he really paid a reasonable cost for his life insurance over time, or has he simply kept the life insurance distribution system going?

A few years ago one of my clients received a proposal from his agent to replace a second-to-die no-lapse universal life policy that the agent had sold three years earlier. The new policy had lower guaranteed costs going forward, so the replacement arguably made sense. But what was the result looking back to the beginning? My client had paid premiums of about $90,000 and had a cash surrender value to roll over of about $30,000. So he had paid $60,000 for three years of second-to-die term insurance, which probably had an actuarial value of less than $1,000.

You cannot win the National Life Insurance Consumer Competition with that strategy.

I’ll admit that the details of this competition are fuzzy, but that doesn’t matter. As soon as you begin to compare the lifetime costs of one real-world purchase strategy with another, you become more aware of the factors that will determine how much you will wind up paying for your life insurance. And that has to lead to better purchase decisions.

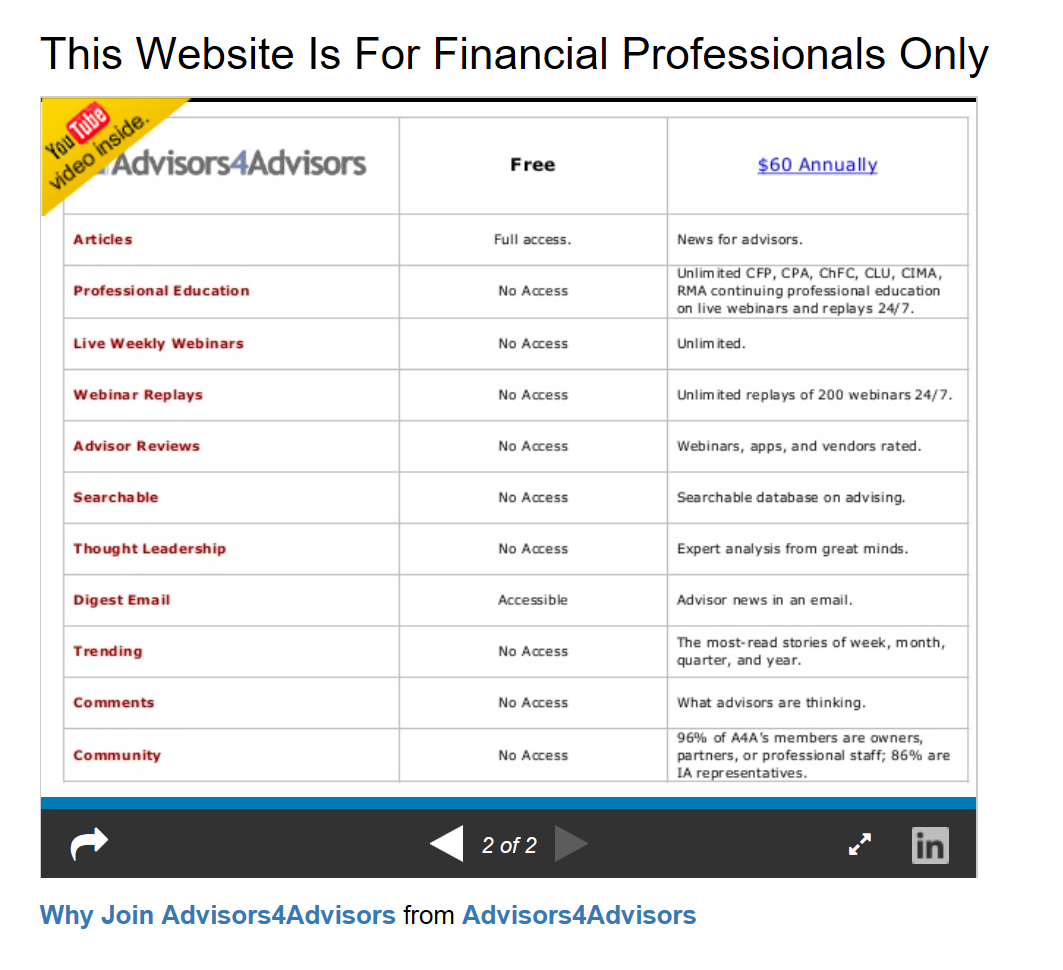

This Website Is For Financial Professionals Only