For Financial Advisors, U.S. Energy Independence Could Mean Radically Different Financial Planning And Investing Assumptions In The Next Few Years

In closely tracking developments in the energy arena over the last five years, my advisory firm, Stearns Financial, regularly speaks with energy company executives, petroleum engineers, and businesses (public and private) with an interest in energy. Here is the scenario that is developing:

- The U.S. has become the Saudi Arabia of natural gas through enhanced finding techniques.

- Many major companies and coal-fired energy plants are re-tooling their energy footprint to natural gas. With the large spread between the price of natural gas (which is low) and diesel (which is high), a trucking company can re-tool its trucks to natural gas and recoup the cost in a year or two.

- Liquefied Natural Gas (LNG) facilities are being built in New Orleans and elsewhere that will be exporting LNG in only a few years. The U.S. is now set up to be the low-cost provider of LCG to the world.

- The Bakkan shale region in North Dakota and Eastern Montana is benefiting from improved technology. The cost of this hard-to-extract oil is about $60 per barrel and dropping. Reserves are estimated at twice Prudhoe Bay’s. It is a game-changer. And the political hot-potato pipeline from Canada that has been in the news? It’s on hold until after the election, but private entities are now looking at building pipelines paralleling existing ones to create an “express highway” by 2015.

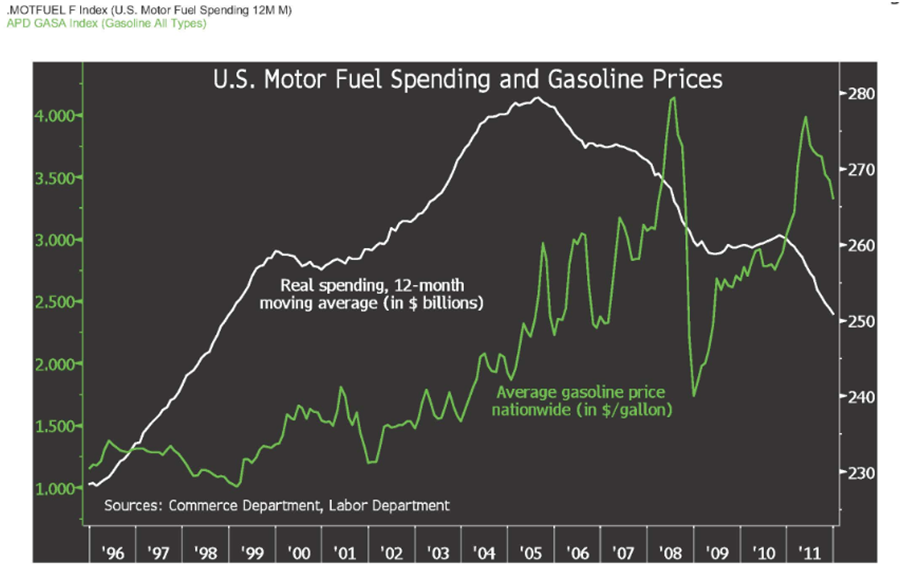

- Enhanced fuel-efficient cars, planes, and buildings are also having an effect. A little-told story is that gasoline demand in real terms has actually been falling since 2005.

The result of all these factors is an emerging scenario in which the U.S. will be energy independent in 10 years or less, possess a less volatile and possibly less expensive energy supply, and be a major energy exporter.

Downsides? There are a few. Shale oil is dirtier and requires enhanced technology, which is coming, to reduce pollutants. Natural gas “fracking” techniques have raised environmental concerns, even though evidence now shows that proper well construction poses no risk to aquifers. Small earthquakes in Ohio were caused by irresponsible drillers using poor construction and fracking techniques.

It’s good to remember that every game-changing shift in the world was accompanied by lots of handwringing and various levels of early, messy challenges. The US energy scenario is likely to be no different.

What could the emerging U.S. energy independence scenario do to GDP growth in the U.S. over the next decade? It would improve economic growth by at least 1% per year (all-in economic effect), and second- and third-derivative effects could even be greater. What might it do for the stock market? Likely move it to normal historical levels, up from where it is now. What would it do for the national psyche? Likely give us a renewed sense of hope.

Perhaps the future isn’t as bleak as some would suggest. When you “play the movie” in scenario learning, you accept the fact that the future will likely turn out to be different than you imagine, but great business leaders and investors watch the direction of secular trends. The U.S. Energy Independence scenario is one of those secular trends to keep an eye on since it could change planning and investing assumptions radically if it progresses on its current course.