Is The CFA Designation Overtaking The CFP As The Pre-Eminent Designation For Providing Financial Advice To Individuals? Hot

Write Review

I’ve lately written about challenges to the CFP business model, the future of the CFP profession, and the financial planning movement in America.

Though the financial planning movement grew rapidly in the 1970s, 1980s, and 1990s, its future is less clear.

One complication is the length and severity of the economic downturn. While the CFP endured previous recessions the current cycle is longer and deeper. It’s eroded the middle class and shrunk the ranks of the mass affluent.

Making matters worse for the CFP designation is the growing popularity of the Chartered Financial Analyst designation.

Though the CFP has long been the most recognized and respected financial advice credential, CFAs have gained strength in recent years.

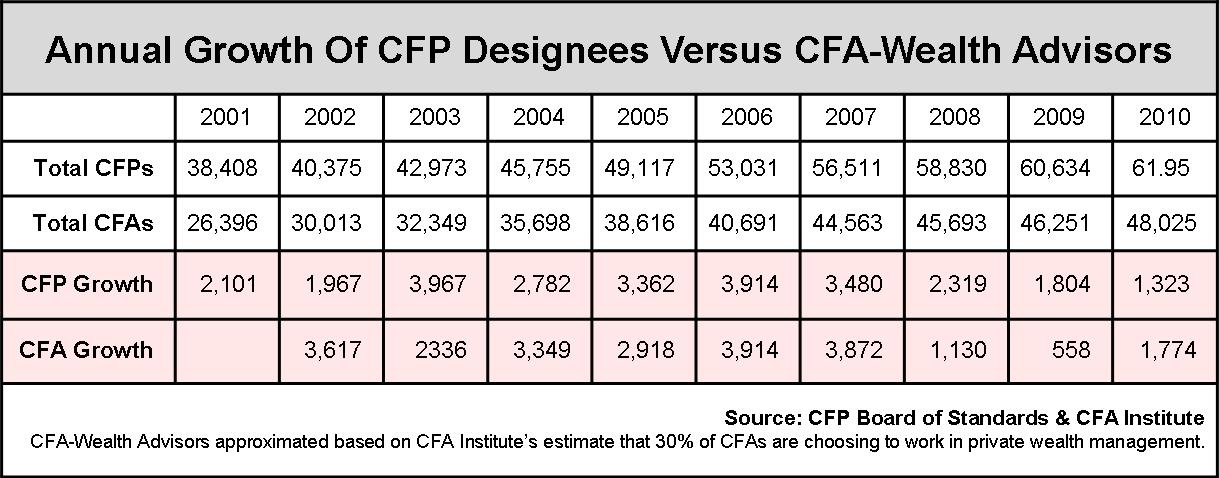

Growth in the two designations has been neck and neck over the past decade. About as many CFA wealth-advisors annually have entered the investment advice industry in recent years as CFPs.

Consequently, the direction of the independent financial advisor profession—toward the CFP or CFA designation—is likely to be decided in the decade ahead.

The stakes are high in this battle to become the most popular designation for financial advice professionals.

CFPs were on a roll for many years. In the 1980s and 1990s, the CFP designation was embraced by wirehouses as well as independent advisors. Now, however, wirehouse brokers seeking to professionalize have a choice other than the CFP designation.

The CFP Board’s focus on doing what it deems as best for consumers collides with positions of the wirehouses. For example, SIFMA, the trade group for wirehouses, opposes the CFP Board proposal to apply to brokers the fiduciary standard mandated under the Investment Advisers Act of 1940. That’s the biggest issue to face the finance advice business in many years.

As independent advisors have grown in number, the fee-only financial planner movement—represented by the Financial Planning Coalition—is no longer as important a force in shaping the direction of the independent advisor industry. A more heterogeneous advisor industry is taking shape, populated by CFAs as well as CFPs.

The nation’s 60,000 CFP licensees will not suddenly become extinct. But the CFP could permanently fade in importance and be overtaken by the CFA. It could be relegated to the No. 2 designation for retail clients.

The CFP-CFA rivalry is going to be major theme in shaping the independent advisor industry. CFAs are more focused on investing. Their clients don’t need budgets, college funding plans, and long-term cash-flow forecasts. The clients of CFAs need risk management, strategic tax advice, and estate planning, and financial planning is not nearly as important in their work as it is in the CFP’s approach.

This battle for preeminence between the CFP and CFA designations will be a big factor in the industry over the next decade.

This Website Is For Financial Professionals Only

User reviews

There are no user reviews for this listing.